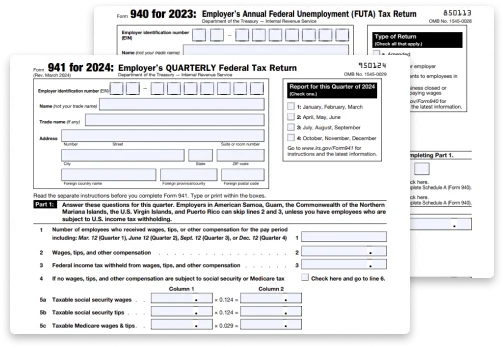

New 2024 requirements that impact Reporting Agents

- Starting with tax year 2023, previous Form 940-PR filers will now use Form 940. Additionally, they will have the choice to file the new Spanish language Form 940 (sp).

- Starting with the first quarter of 2024, previous Form 941-SS filers will transition to filing Form 941, tailored for their use in the revised version issued for this quarter.

- IRS Mandates Reporting Agents to E-file Payroll forms for the 2024 Tax Year.

A Closer Look at Reporting Agents

- A Reporting Agent can be an individual or an entity authorized by a taxpayer to prepare and file their tax returns with the Internal Revenue Service (IRS). This includes tax preparers, accountants, or firms specializing in tax compliance.

- To be a reporting agent, you should get an 8655 (reporting agent authorization) form, from each client who needs to file their return on their behalf.

With the form 8655, you have the right to do the following:

- Sign and file certain forms

- Make deposits and payments for certain returns

- Receive duplicate copies of tax information, notices, and other communication from the IRS

- Provide the IRS with information to aid in penalty relief determinations

- A reporting Agent can co-exist with Form 2848 and Form 8821

Supported Forms for Reporting Agents by TaxBandits

94x Forms

- Form 941

- Form 940

- Form 941 SP

- Other 94x

1099 Forms

- 1099-NEC

- 1099-MISC

- 1099-K

- Other 1099s

1042 Forms

- Form 1042

W-2 Forms

- W-2

- W2-PR

- W-2C

State Filing

- 1099 State Filing

- W2 State Filing

Benefits of E-Filing as a Reporting Agent using TaxBandits

Bulk Upload Excel Templates

Eliminate manual entry with our user-friendly Bulk Upload option, simplifying the import of client data.

E-sign using RA PIN

Gain authorization to file Form 941 using your online signature PIN (RA 5-digit PIN).

Multiple Options to Pay IRS Balance Due

TaxBandits offers solutions for paying taxes due and deposits using EFTPS, EFW, or choose to pay by check or money order.

Supports Postal Mailing

Opt-in to TaxBandits’ Postal Mailing services to have copies mailed to your clients for their recordkeeping needs.

Exclusive PRO Features - for Reporting Agents

Client Management

Client Management tools empower reporting agents to efficiently manage their clients. They enable you to invite clients to a separate portal and communicate with them regarding any tax filing-related questions.

Staff Management

Staff Management enables reporting agents to optimize their workflow. You can securely invite an unlimited number of staff members to access your account and assign them roles as needed to fulfill their filing responsibilities for your clients.

Automated Reports

TaxBandits offers robust reporting tools that provide insight into your clients’ filings, your team’s account activity, and more, improving organization and streamlining filing efforts for your business.

Record Keeping

In compliance with IRS regulations, all form copies are securely stored on our HIPAA-compliant server for up to 7 years. You can conveniently access your TaxBandits account at any time to download or print copies.

Learn how TaxBandits can assist you in meeting your filing needs with a live demo.

Affordable Pricing that fit your need

Bulk Pricing

TaxBandits provides exclusive volume-based pricing, allowing Reporting Agents to electronically file payroll forms in bulk for their clients at discounted rates. As the number of forms filed increases, so do the savings!

Prepaid Credits

Reporting Agents have the option to purchase prepaid credits in advance through their TaxBandits account, eliminating the requirement for separate payments for each filing. This feature is particularly effective for managing multiple clients.

Frequently Asked Questions about Reporting Agents

How can the Reporting agent sign a return?

Reporting Agents sign all of the electronic returns they file with a 5-digit PIN signature. If your application is approved, the IRS will assign you a Reporting Agent PIN.

How to apply for a RA PIN?

The IRS will review your application and verify the information provided. The IRS will provide you a 5 digit PIN by authorizing you as a reporting agent.

- Have each client complete and sign a Form 8655.

- Complete a “Reporting Agent’s List.”

- Send the Form 8655 along with a “Reporting Agent’s List” to the IRS.

What is the New IRS filing requirement for reporting agents?

The IRS Mandates Reporting Agents to E-file Payroll forms from the 2023 tax year.

Connect with

The TaxBandits Support Team

Our team is here to help you by phone, email, and live chat